Lululemon doesn’t own any factories. Instead, it works with elite OEM partners across Asia. Countries like China, Vietnam, Sri Lanka, and Bangladesh play key roles in producing its high-performance athletic apparel and accessories.

Lululemon’s Asset-Light Manufacturing Model

Lululemon operates under an asset-light factory model. That means the company doesn’t own or run any production facilities. Instead, it partners with Original Equipment Manufacturers (OEMs) that specialize in everything from fabric innovation to large-scale garment production.

This approach gives Lululemon unmatched flexibility. It can scale production quickly, shift sourcing between regions, and stay agile in response to global supply challenges. By outsourcing manufacturing, Lululemon can focus its internal resources on product design, quality standards, and sustainability goals.

These aren’t short-term arrangements. The company builds long-term partnerships with its OEM factories, working collaboratively on innovation and ethical oversight. Many of Lululemon’s manufacturing partners are repeat suppliers chosen for their expertise in technical fabrics, quality control, and labor standards.

Global Manufacturing Footprint: 20 Countries and Counting

Lululemon sources from more than 100 Tier-1 factories across over 20 countries. This vast and diversified network supports global demand while helping the company manage risks tied to tariffs, political shifts, or natural disruptions.

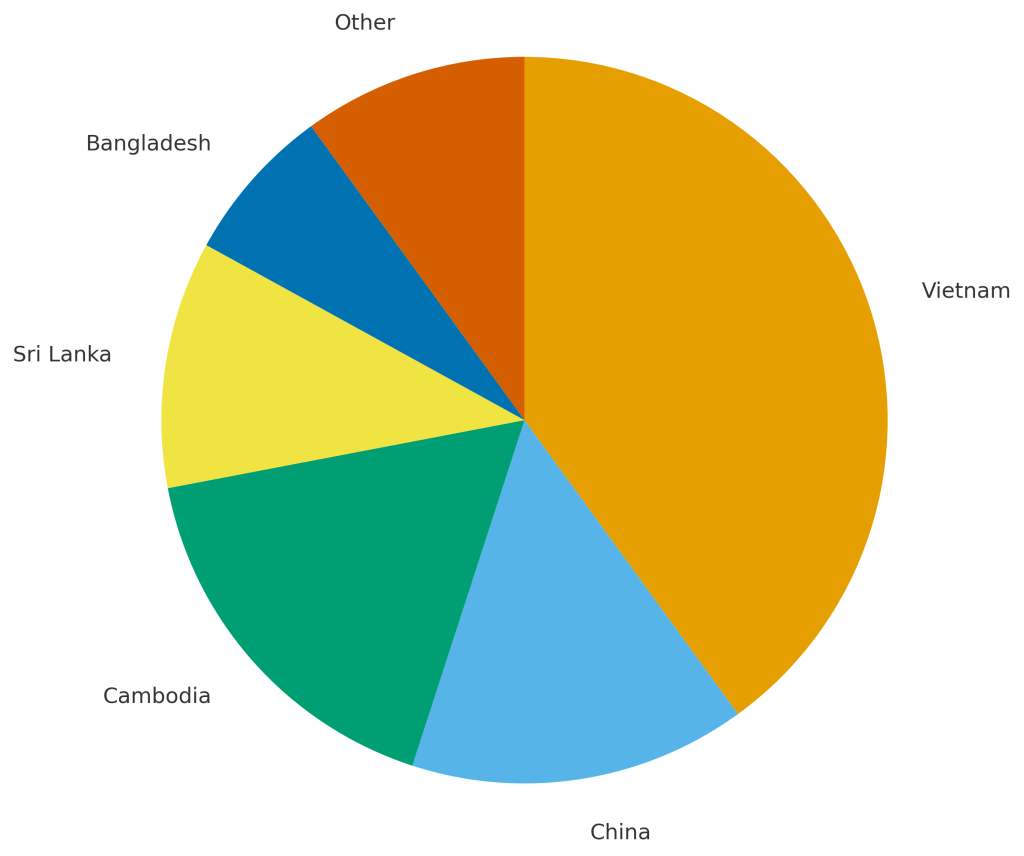

Lululemon Manufacturing by Country

Vietnam currently leads in output, accounting for roughly 40% of Lululemon’s total production. China, once dominant, now contributes about 15%. Other key players include Cambodia (17%), Sri Lanka (11%), and Bangladesh (7%).

The shift toward multiple countries is deliberate. It helps spread operational risk and gives Lululemon room to respond to geopolitical trade issues, such as the U.S.-China tariffs. This multi-region model also lets the company balance cost, quality, and lead time across different product categories.

The Role of China in Lululemon’s Supply Chain

China’s role in Lululemon’s factory network has evolved. Once the dominant source, it now represents about 15% of global output. But that percentage doesn’t tell the full story.

Chinese OEMs still play a critical role in producing Lululemon’s core activewear, particularly high-performance leggings, bras, and technical tops. What makes China indispensable isn’t just volume—it’s the technical edge.

Factories in China are leaders in seamless knitting, advanced dyeing, and premium material development. These capabilities are vital for producing Lululemon’s signature fabrics and complex garment designs.

Shenzhou International, based in Ningbo, stands out as a key example. By 2023, it had become Lululemon’s second-largest OEM globally, thanks to its ability to deliver consistent quality at scale.

Lululemon OEM Partners by Product Line

Leggings & Yoga Pants – Eclat, Crystal, Shenzhou, Ghim Li

Lululemon’s leggings are made by a select group of specialists:

- Eclat Textile (Taiwan/Vietnam) is a core supplier known for vertically integrated production of proprietary fabrics like Luon® and Nulu™.

- Crystal International (HK/China/Vietnam) brings scale with high-volume, knit performance wear.

- Shenzhou International (China/Vietnam) handles mass production with cutting-edge automation.

- Ghim Li (Singapore/Malaysia/Vietnam) delivers reliable quality for basic knit items.

These partners allow Lululemon to maintain quality while meeting demand across multiple markets.

Sports Bras & Intimate Activewear – MAS Holdings, Regina Miracle, Brandix InQube

Lululemon works with intimatewear experts for its sports bras:

- MAS Holdings (Sri Lanka) specializes in bonded seams and high-support construction.

- Regina Miracle (HK/Vietnam) focuses on foam-cup molding and precise stitching.

- Brandix/InQube (Sri Lanka) blends lingerie techniques with performance materials.

- Smaller Chinese suppliers like Dongguan Quick Feat support with stretch components.

Each supplier brings niche capabilities to ensure comfort, fit, and function.

Tops & Shirts – Shenzhou, Crystal, Hansae, Esquel

Production of tanks, tees, and polos is split among:

- Shenzhou International (China) for premium long-sleeve and knit tops.

- Crystal Group (Vietnam/China) for tanks and casual wear.

- Hansae (Vietnam) for high-volume, lightweight basics.

- Esquel Group (HK/China) for woven shirts and more structured styles.

These partners reflect how Lululemon sources both technical athletic tops and everyday casual wear.

Outerwear – Quang Viet, Youngone, Makalot

Lululemon’s cold-weather gear and jackets are made by:

- Quang Viet (Vietnam), a specialist in insulated outerwear.

- Youngone (Bangladesh/Vietnam), known for jackets and technical gear.

- Makalot (Taiwan/China), which handles lighter layers like fleece and hoodies.

Each plays a specific role in fulfilling Lululemon’s outerwear demands.

Accessories & Footwear – ASI Suzhou, Yue Yuen (Pou Chen), Goodway, Chung Jye

Accessories and shoes require their own specialized OEMs:

- ASI Suzhou (China) makes hats and headbands.

- Shanghai Yulu (China) produces yoga mats and water bottles.

- Goodway/Athena VN (Vietnam) builds women’s sneakers.

- Chung Jye (China) handles high-quality shoe assembly.

- Youngone (Bangladesh) supplies gym bags and packs.

This tailored sourcing ensures each product type is made by the most capable partner.

China’s OEM Advantage: Why Lululemon Still Relies on It

China continues to offer unmatched technical manufacturing capabilities. Its factories lead in automation, fabric innovation, and scalable operations. This is especially valuable for core product lines that require precision, such as leggings and technical tops.

Facilities like Shenzhou’s Ningbo campus are highly automated, ensuring efficient and consistent output. While other countries now produce more of Lululemon’s overall volume, China remains the go-to for complex, high-quality garments that define the brand.

Ethical and Sustainability Standards Across Factories

Lululemon’s commitment to responsible manufacturing applies globally, including in China. Every supplier must meet standards covering:

- Labor rights and fair wages

- Health and safety protocols

- Environmental performance

Chinese factories such as Shenzhou and ASI Suzhou are part of these audited programs. All factories listed in Lululemon’s April 2025 Supplier List must adhere to its ethical sourcing code and environmental benchmarks.

Summary Table – Top Lululemon Factories by Category

| Category | Key Suppliers | Main Locations | Specialty |

|---|---|---|---|

| Leggings & Yoga Pants | Eclat, Crystal, Shenzhou, Ghim Li | Vietnam, China | Performance knits |

| Sports Bras & Intimates | MAS, Regina Miracle, Brandix | Sri Lanka, Vietnam | Bonded bras |

| Tops & Tees | Shenzhou, Crystal, Hansae | China, Vietnam | Knit tops |

| Outerwear | Quang Viet, Youngone | Vietnam, Bangladesh | Down & shell jackets |

| Accessories & Footwear | ASI Suzhou, Yue Yuen, Goodway | China, Vietnam | Shoes & bags |

The Future of Lululemon Manufacturing

As global supply chains continue to shift, Lululemon is expanding its reach beyond traditional partners. While China remains a critical source of premium technical gear, new sourcing regions like India and Indonesia are emerging as viable alternatives.

This reflects broader trends in nearshoring and diversification, especially after disruptions from the COVID-19 pandemic. Lululemon’s future factory locations will likely mirror its current strategy: prioritizing quality, ethical compliance, and the ability to scale without owning facilities.

Conclusion

Lululemon doesn’t manufacture any of its products in-house. Instead, it relies on a sophisticated network of world-class OEM factories. China continues to be a cornerstone of this model, especially for leggings, bras, and tops. Meanwhile, countries like Vietnam, Sri Lanka, and Bangladesh provide scale, cost-efficiency, and category-specific expertise.

This decentralized model gives Lululemon the agility to innovate, respond to global challenges, and uphold high production standards across all product lines.